Understand How To Prepare, Plan, and Proactively Manage Your Firm’s Finances for Success

Contingency fee law firms thriving post-pandemic focus on three key elements: preparation of financial forecasts, planning for intakes and cash flow disruptions, and proactive management of their case inventory.

As the market for legal representation heats up, law firms with the liquidity to invest in growing intakes, updating infrastructure to better serve today’s clients, and implementing advanced case management systems are pulling ahead of the field. In order to ensure liquidity and be in a cash-rich position for investment in growth, law firms need to have rigorous financial forecasts and the ability to tap into large cash reserves at the drop of a hat.

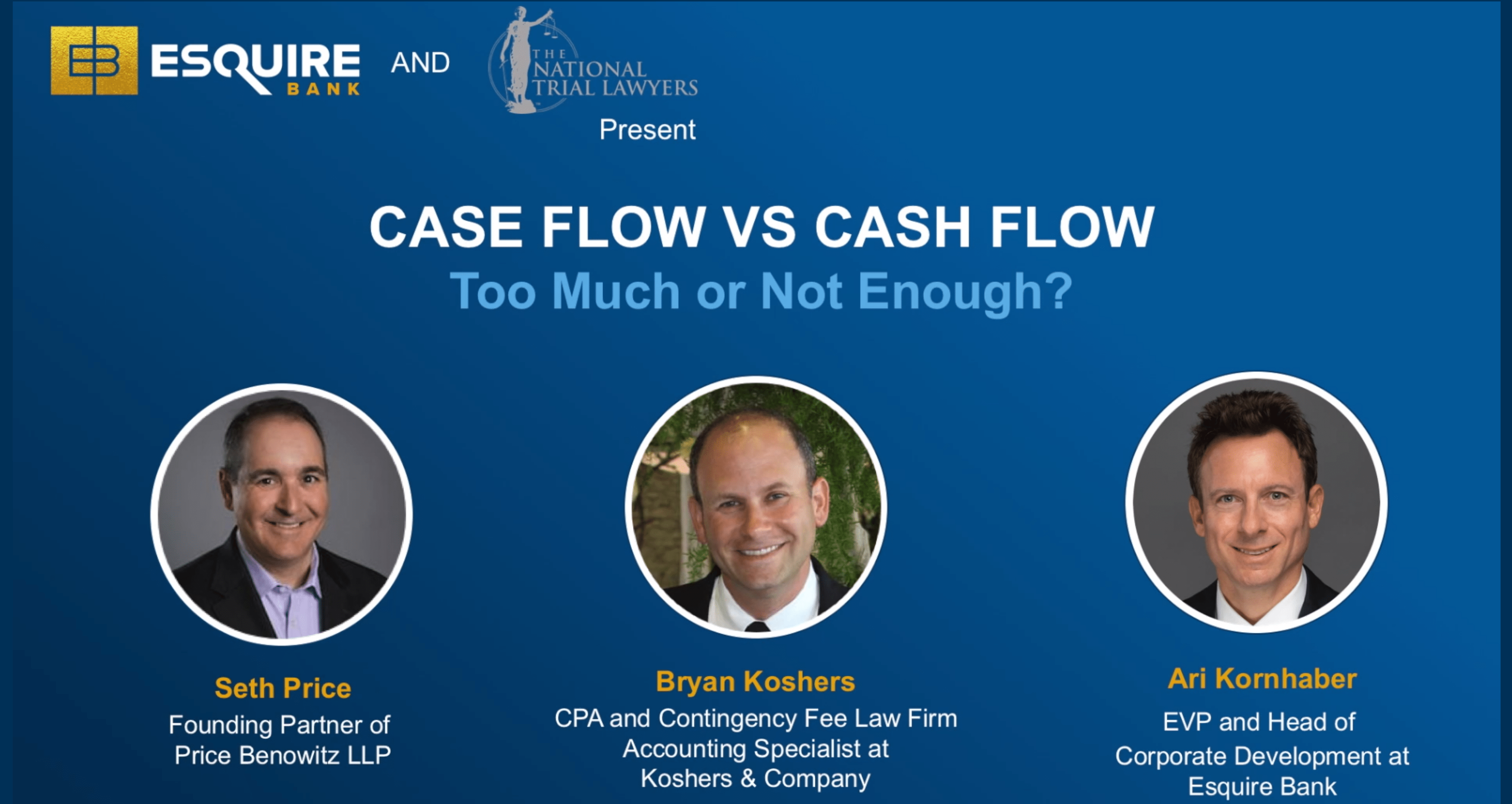

Watch the following (5 min) video featuring Ari Kornhaber — EVP & Head of Corporate Development at Esquire Bank — to understand how the use of smart lending can help you prepare, plan, and proactively manage your firm’s finances for success.