Bernheim Kelley, LLC sought to expand nationally, increase its case inventory, and invest in marketing, technology, and talent. However, like many contingency fee law firms, it faced financial constraints that limited growth and the ability to take on high-value cases.

Overview

Bernheim Kelly, LLC Case Study

Bernheim Kelley, LLC, a Florida-based, full-service personal injury law firm founded by Jesse Bernheim, leveraged its partnership with Esquire Bank to fuel geographic expansion and dramatically increase case fees. Through Esquire Bank’s flexible financing solutions, Bernheim Kelley, LLC increased its marketing spend by 414% over three years, leading to a 735% increase in case fees. This alliance positioned the contingency fee law firm as a leader in high-stakes personal injury and mass tort litigation, securing significant victories against major players in the tobacco, pharmaceutical, and medical devices industries and living up to their promise to clients to deliver “real justice.”

From Regional Advocate to National Contender

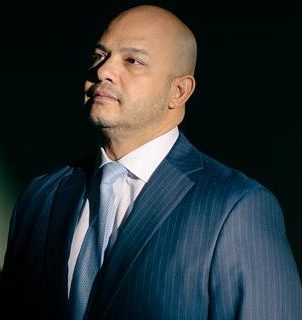

Founded as a regional personal injury firm, Bernheim Kelley, LLC earned a solid reputation for advocating for clients harmed by unethical business practices or workplace injuries. Founder and CEO of BK Law, Jesse Bernheim, was one of the few attorneys courageous enough to take on Big Tobacco. He was particularly moved by stories from people who had been exposed to tobacco products at a young age in the poorest areas of Boston, essentially creating addicts for life. This deep sense of injustice motivated Jesse to take on these cases, winning over $230 million in verdicts for his clients.

In the medical devices industry, Jesse also recovered over $74MM for clients harmed by defective hip implants.

Jesse Bernheim was one of the few attorneys courageous enough to take on Big Tobacco

Challenge

Navigating Cash Flow Strains and Capital Constraints

Despite these significant victories though, like many contingency fee law firms, BK Law faced the familiar challenge of balancing case investments with business growth initiatives while maintaining cash flow. Jesse recognized the need for capital to scale nationally, but was constrained by the limitations of self-financing.

While the firm maintained healthy cash flows, addressing all these hurdles at once would have limited their ability to handle any unforeseen challenges. BK Law needed a solution to break through these limitations and pursue its ambitious growth plans. Fortunately, in 2019, Jesse partnered with Esquire Bank, allowing the firm to sustain operations and growth throughout the pandemic. While the pandemic brought the justice system to a near standstill, Jesse was able to continue supporting his staff while growing the firm’s case inventory.

The firm faced several key hurdles:

• Limited capital for expansion into new markets and practice areas

• Constraints on marketing budgets, hindering client acquisition

• Inability to invest in cutting-edge technology and talent

• Challenges in taking on more complex, high-value cases due to cost concerns

Using a Case Cost Line of Credit from Esquire Bank, the firm experienced growth without disrupting cash flows

Solution

Tailored Financing, Transformative Results

Esquire Bank proved to be a strategic ally who understood the nuances of contingency fee law firm operations. Esquire Bank’s specialized financing solutions and industry expertise provided the law firm with the resources it needed to overcome persistent growth barriers.

With a flexible Case Cost Line of Credit from Esquire Bank, the firm was able to grow its case inventory — specifically growing its mass tort inventory by 77% — without disrupting cash flows. The Working Capital Line of Credit allowed BK Law to hire additional attorneys and support staff, accelerating the firm’s growth. The success and stability afforded by these two customized financial tools led BK Law to entrust all its banking needs with Esquire Bank.

“Esquire Bank provides us with a lot of tools and services that other banks don’t. [They] know our needs as a plaintiff’s law firm and really understand how we operate. That sort of insight into our business plays a tremendous role in making our relationship better than with another bank,” said Jesse.

With Esquire Bank’s support, BK Law is making significant investments in its future, building a lasting legacy of

advocacy against corporate giants.

• A 735% revenue increase

• A 76% ROI increase in marketing

• Successful geographic expansion across the East Coast and Midwest

Result

Turning Ambition into Achievement

Reflecting on the transformation, Jesse remarked:

“Our partnership with Esquire Bank has been a game-changer. We’ve been able to take on cases we never could have before, invest in marketing that has dramatically increased our reach, and build a team of top-tier professionals. The result is a firm that’s now a national leader in personal injury and mass tort litigation.”

Looking to the future, BK Law is well-positioned for continued expansion and success. Their partnership with Esquire Bank provides the financial foundation to pursue new opportunities, invest in emerging legal technologies, and continue its mission of delivering “real justice” to clients nationwide.

With its strengthened financial position and rapidly expanding national footprint, Bernheim Kelley, LLC stands as a testament to the power of strategic financial partnerships in driving law firm growth and success.

Is Your Law Firm Ready for Growth?

Use our insightful Growth Assessment tool to see if your firm is well-positioned for growth. Find out what stage of growth your firm is currently in and the next steps you should take to drive growth for your contingency fee law firm.

Let’s Talk About a Better Way to Bank for Your Contingency Fee Law Firm

Explore this infographic to learn more about our Deposit Solutions and how a partnership with Esquire Bank can help you Succeed Boldly. See our banking benefits, hear from current Esquire clients, and discover just how easy it is to make the switch.