Case Cost Financing Solutions

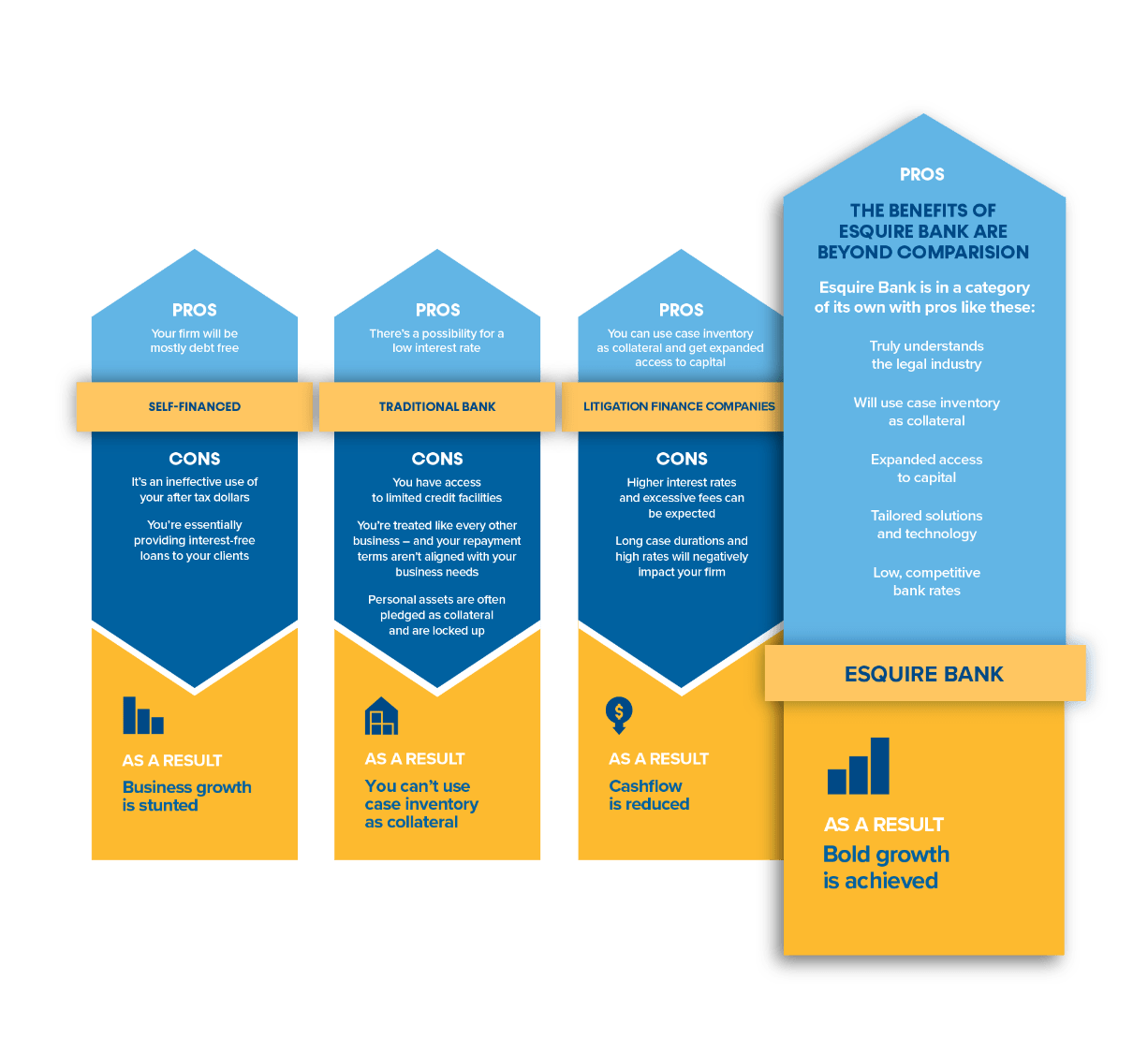

Contingency fee law firms should never feel the need to settle for less or refer-out their cases due to capital constraints. A better solution for case disbursements exists that will help you maximize the value of your cases and help you attain justice for your clients.

Case Costs and Case Inventory Can Be Used As Collateral

Our case cost line of credit provides qualifying contingency fee law firms with access to funds to cover out-of-pocket expenses for the duration of a lawsuit by using their case costs and case inventory as collateral.

The Case Cost Line of Credit

Law firms nationwide have caught on to the benefits that come with using a line of credit to pay for case costs. The injection in liquidity that you get when you don’t have to pay for case costs out of your own law firms pocket, provides contingency fee law firms with the flexibility and financial confidence to invest in their law firm.

Unlock capital tied in case costs to strategically invest in the expansion and growth of your law firm.

Where applicable pass on the cost of financing to end client resulting in a cost-effective financing solution to your law firm

Track and manage case disbursements for your clients with hi-tech solutions tailor made for contingency fee law firms

Join an elite group of law firms nationwide who are leveraging case cost financing to grow their law firm exponentially

Deliver Greater Client and Case Value

Catastrophic injury cases often require substantial financial resources, including funds for medical expert fees, investigations, court costs, and other litigation expenses. These case costs quickly add up. When your law firm has liquidity and capital with Esquire Bank to spend on case disbursements, it can deliver greater client and case value – and ultimately more revenue.

Expanding Case Inventory to Scale Law Firm Growth: Daly & Black

In this blog, it highlights how Texas personal injury attorney John Black partnered with Esquire Bank, finding the access to capital that helped Daly & Black scale law firm growth and invest in case resources.

Watch Video

Diversify to Accelerate Revenue While Awaiting Outcomes

While your outcomes may be substantial, the time it takes to complete a case may be lengthy. Diversifying your practice can help you accelerate and smooth cash flow while you await judgements or settlements. Financing with Esquire Bank can help you expand into higher volume practice areas that can generate consistent income to support larger specialized matters, as well as fund your growth.

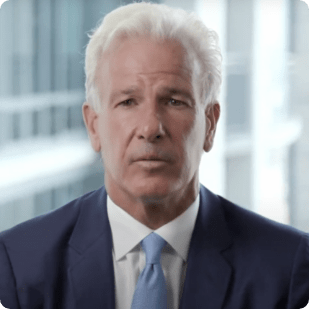

Unleashing Law Firm Growth: Angel Reyes Success Story

How Dallas-based personal injury attorney Angel Reyes partnered with Esquire Bank and overcame the capital limitations of traditional, commercial banks, unleashing law firm growth.

Watch Video

Expertise That Can’t Be Overstated

Founded by lawyers for law firms, Esquire’s experts have an unmatched depth of understanding of the legal industry and its specific financial requirements. We are familiar with the unique challenges, cash flow patterns, and regulatory considerations that you face. Leverage our experience and purpose-built financial products and services to maintain liquidity for operations and disbursals, mitigate compliance risks, and deliver more drive client and case value.

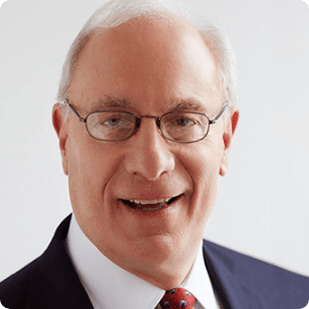

How Levy Konigsberg Found a True Law Firm Banking Partner

Levy Konigsberg Managing Partner Moshe Maimon explains why traditional banks fail to understand the needs of contingency fee law firms, and how Esquire Bank’expertise and support enabled his firm to invest in the firm and cases.

Watch Video

Discover the Advantages of Financing with Esquire

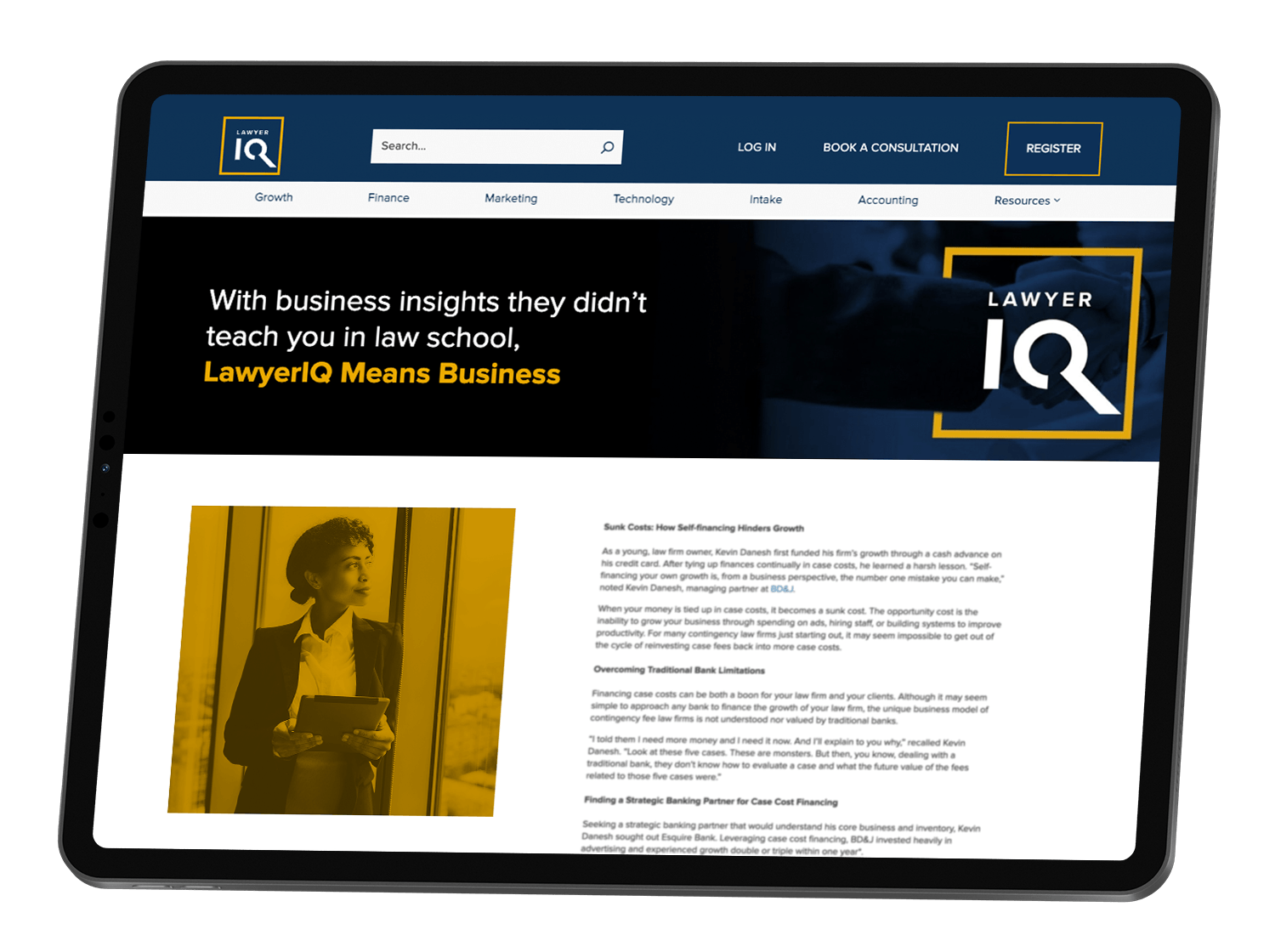

5 Best Practices from Law Firms That Are Growing and Succeeding Boldly

Discover law firms across the U.S. who partnered with Esquire Bank and are writing the book on achieving exponential growth with innovative strategies. See how:

- Silberstein, Award & Miklos doubled in size, client base, and revenue

- Grewal Law increased revenue 162% over two years

- Atlas Consumer Law expanded its geographic reach from 5 to 17 states

![5 Best Practices eBook cover for Law Firms Growing and Succeeding Boldly | Esquire Bank. [Working Capital Solutions]](https://esquirebank.com/wp-content/uploads/2023/05/Esquire_5BestPracticesFirmsGrowingSucceedingBoldly_iPad-Cover.png)

Boldly Successful Firms

“Since allying with Esquire Bank and leveraging its case cost financing solutions, Lerner & Rowe has grown case fees by 26%, marketing expenses by 22%, and significantly increased profits in a single year.”

Glen Lerner Founding Partner

“Since partnering with Esquire Bank, TorkLaw has grown to a staff of 60, doubled the value of its case inventory, and increased marketing spend by +71% and revenue by +74% while expanding nationwide.”

Reza Torkzadeh CEO & Senior Partner

“Esquire Bank is quite different. It’s like I have my own personal banker that I can actually call on the phone and I can talk about what my needs are.”

Mick Grewal President and CEO

“Esquire Bank understands the personal injury law space, our inventory, and how to value our inventory. It’s just been night and day in regard to dealing with Esquire Bank as compared to a traditional bank.”

Sam Pond Managing Partner

“The cases move faster, they come up for trial faster, and we see settlements faster because of the cooperation and partnership with Esquire Bank.”

Phil Russotti Senior Partner

Laffey Bucci D’Andrea Reich & Ryan

Since partnering with Esquire Bank, personal injury law firm Laffey Bucci D’Andrea Reich & Ryan has increased case fees by 365% and significantly increased operations. Most notably, the law firm utilized case cost financing to invest in resources to help pursue and win a $52 million civil sexual abuse case settlement.

Read Full Case StudyRecommended Content From LawyerIQ

Esquire Bank Donates Additional $75,000 to Support Long Island Charities

Year-End Giving Brings Total 2020 Contributions to $200,000 JERICHO, N.Y. – December 2020 – Esquire Bank, N.A. (“Esquire”), a New

Read More about Esquire Bank Donates Additional $75,000 to Support Long Island Charities