Working Capital Solutions

From funding your day-to-day operations to covering your case costs, working capital solutions from Esquire Bank can help your firm cover expenses, smooth cash flow and unlock growth opportunities.

Peace of Mind to Grow Your Firm

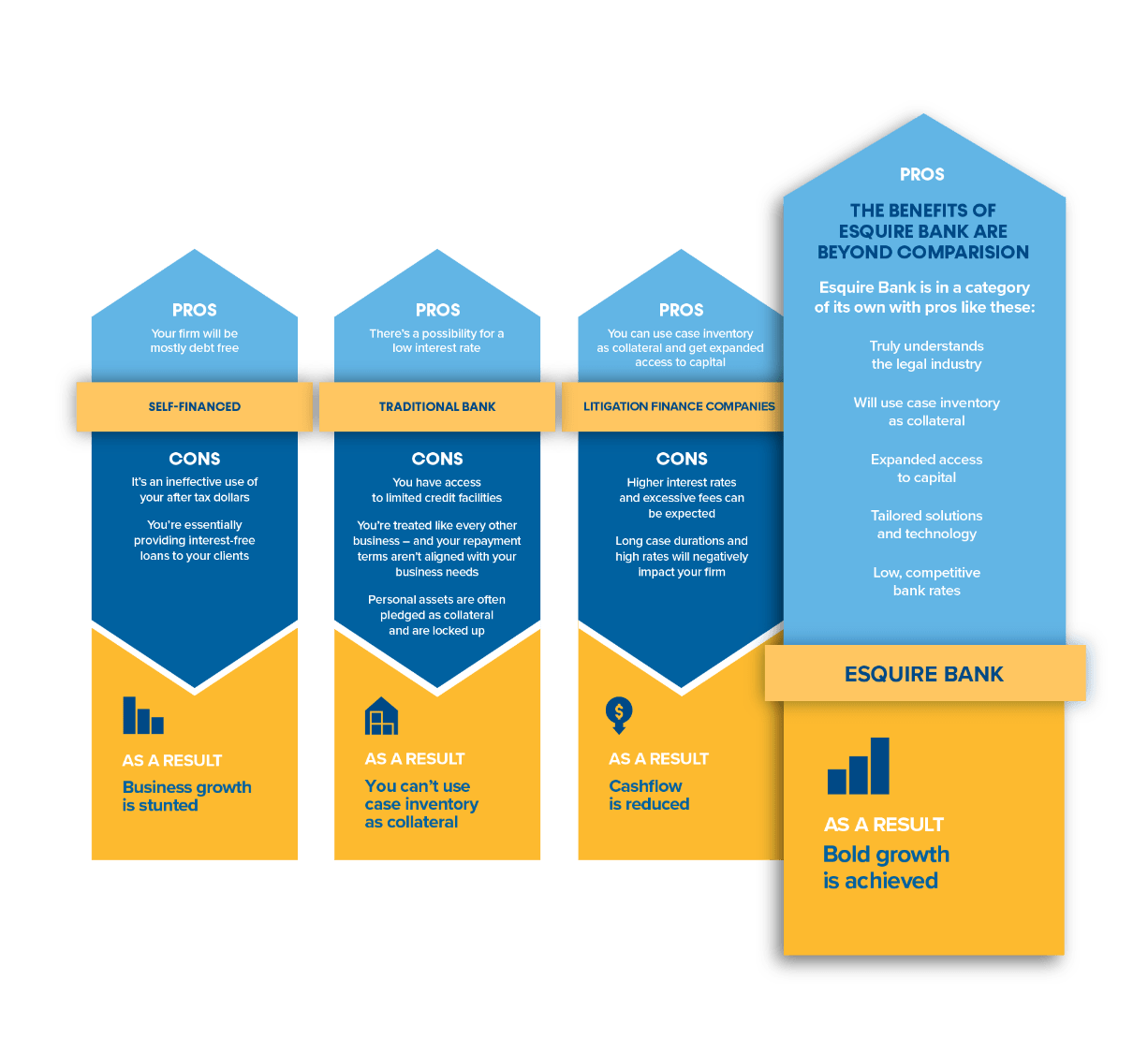

Whether mitigating outstanding invoices or awaiting the outcome of a lengthy trial, cash flow challenges and unpredictability can stunt your growth or, worse, risk your ability to meet your own financial obligations. Esquire Bank supports firms nationwide with access to the working capital they need to ensure stability and continuity, while enabling growth.

Working Capital Tailored for Law Firms

Esquire Bank is a highly tailored bank specializing in servicing the unique financial needs of the legal industry. We understand your law firm’s unique business model. And, we know that your case inventory is your law firm’s most valuable asset and should be used as collateral for financing purposes. This sets us apart from other financial institutions – and it sets law firms up to be boldly successful.

![Legal law books on a shelf, representing legal services and expertise at Esquire Bank. [Working Capital Solutions]](https://esquirebank.com/wp-content/uploads/2023/06/AdobeStock_68337228.png)

Case Cost

Line of Credit

With a master line of credit specifically for case costs, this popular form of financing can give your law firm greater business agility, growth and client impact.

![Modern business banking consultation at Esquire Bank office with professional advisor. [Working Capital Solutions]](https://esquirebank.com/wp-content/uploads/2023/06/AdobeStock_181656101.png)

Working Capital

Line of Credit

This flexible revolving line of credit from Esquire Bank provides access to funds when you need them and can support gaps in your firm’s short-term cash flow needs.

Deliver Great Client and Case Value

Expert witnesses. Forensics. Medical reports. Case costs quickly add up. When your law firm has the liquidity and capital to spend on case disbursements, it can deliver greater client and case value – and ultimately more revenue.

Navigating Case Costs: Leeseberg Tuttle’s Path to Growth

Ohio-based trial lawyer Craig Tuttle explains how he discovered a more effective path to navigating case costs for his contingency fee law firm.

Watch Video![Modern businesswoman using a laptop in a high-rise office with city skyline background at sunset. [Working Capital Solutions]](https://esquirebank.com/wp-content/uploads/2023/06/AdobeStock_598410037.png)

Reinvest in Operations

The path to growth requires law firms to reinvest in the firm’s business operations, including budgeting, staffing, and more. Financing from Esquire Bank can help your firm further establish IT, marketing, and finance departments, strengthening your business while increasing your ability to attract news cases and clients.

Trial Lawyers: 4 Keys to Building Effective Case Intake

Legal markting expert Susan Knape shares four essential strategies for optimizing intake to better service clients and drive law firm growth.

Watch Video![Business team shaking hands during a meeting at Esquire Bank, promoting professional banking services and client relationships. [Working Capital Solutions]](https://esquirebank.com/wp-content/uploads/2023/06/AdobeStock_181392262-min.jpeg)

Modernize Technology, Optimize for Growth

Investing in technology is critical to competing in today’s fast-paced legal landscape. Without the right legal technology in place, it can be impossible to keep up. Turn to Esquire to help you fund and put the right systems in place to make your firm run smoothly, from case management and case intake to financial reporting, document management and more.

How Trial Lawyers Can Use Tech to Acquire High-Value Cases

Modern client acquisition intelligence platforms are revolutionizing how law firms identify, evaluate, and acquire high-value cases.

Read More![Professional businesswoman looking out over a city skyline at night with skyscraper lights. [Working Capital Solutions]](https://esquirebank.com/wp-content/uploads/2023/06/AdobeStock_474676722-min.jpeg)

5 Best Practices From Law Firms That Are Growing and Succeeding Boldly

Discover law firms across the U.S. who partnered with Esquire Bank and are writing the book on achieving exponential growth with innovative strategies. See how:

- Silberstein, Award & Miklos doubled in size, client base, and revenue

- Grewal Law increased revenue 162% over two years

- Atlas Consumer Law expanded its geographic reach from 5 to 17 states

![5 Best Practices eBook cover for Law Firms Growing and Succeeding Boldly | Esquire Bank. [Working Capital Solutions]](https://esquirebank.com/wp-content/uploads/2023/05/Esquire_5BestPracticesFirmsGrowingSucceedingBoldly_iPad-Cover.png)

Discover the Advantages of Financing with Esquire

Atlas Consumer Law

For Atlas Consumer Law, having access to case cost line of credit facilities helped fuel the law firm’s exponential growth, doubling the practice, expanding the firm’s geographic reach from 5 to 17 states, and enabling a robust digital transformation for intake and client services.

Read Full Case StudyRecommended Content From LawyerIQ

Esquire Bank Donates Additional $75,000 to Support Long Island Charities

Year-End Giving Brings Total 2020 Contributions to $200,000 JERICHO, N.Y. – December 2020 – Esquire Bank, N.A. (“Esquire”), a New

Read More about Esquire Bank Donates Additional $75,000 to Support Long Island Charities